BDEL was to be dislisted from exchanges and they decided on a reverse book building for the same. We had talked about it here.

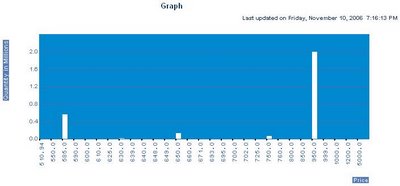

The demand graph for delisting looks like this.

If I am not wrong, 950 is the discovered price in the reverse book building. As on today, 10th November 2006, BDEL was trading at 605 (link). A whopping 86% above the offer price of 550 and 57% above todays closing price. As always, few questions...

There are two things that can happen.

1. BDEL can refuse to accept this price. Now two things can happen - now that we know that Mr. Market thinks that right price for BDEL is 900+ (*) and stock can shoot up and second since there is no more delisting offer from BDEL, the price will fall down.

2. BDEL can accept the discovered price. Again two things might happen - price will shoot up in the open market (people would want to buy more so that they can make a quick buck) or price would come down (very very unlikely that price would come down).

* may be certain section of market - the FIIs and MFs have offered their shares at this price and right price is not 900+?

Questions

1. Will BDEL accept the offer?

2. What happens if BDEL does not accept the offer?

3. Who offered their shares at 950? QIB? FII? Who?

My boss once told me that there is a 33% probability of a change being better than the status quo. Lesson to be learnt is that probability is indeed right sometimes (although I strongly belive that probability hates me - there is a higher probability of me being on the wrong side of probability).

P.S.: This is a personal post and this does not come from Pseudosocial.

New @ PseudoSocial?

Friday, 10 November 2006

Blue Dart Express Limited - Delisting

TimeStamp:

9:02:00 pm

![]()

Labels: Company Analysis, Reverse Book Building

Subscribe to:

Post Comments (Atom)

1 comment:

Dear blogger,

The discovered price of 950 has been rejected by the company.

The companay continues to remain listed.

Rgds

Avinash

avinashkochchar@gmail.com

Post a Comment